Apps like Dave

Want to know Apps like Dave? then you are in the right place. Many people have bored off staying at home during this lockdown, how to earn money will be hitting them hard in their mind. Well, Apps like Dave will be helpful for people to get loans or if you require the money in an emergency to can opt for many cash advance apps like dave. Dave is a digital banking service that offers loans to individuals for overdraft protection. Now let's check out the other Apps like Dave and their features from the below section.

You can use a single app or a combination of these apps to gain better control over your finances. Moreover, you can get some valuable insights to save money and invest in stocks to use for future emergencies. Let’s have a look at the twenty efficient apps that are similar to Dave and that can save you from the tensions of payday loans or overdraft expenses –

List of Apps like Dave

- Earnin

- Moneylion

- FlexWage

- Brigit

- Rainy day lending

- DailyPay

- Branch

- Loan Solo

- PayActiv

- Chime

- Wealthfront Cash Account

- Axos Bank – Direct Deposit Express

- PockBox

- Even

- Affirm

- Ingo Money

- Speedy Cash

- CashNetUSA

- Activehours

- Instapay

- Empower

Cash Advance Apps like Dave

People who are in search of Cash Advance Apps like Dave can have a look at the list of apps given below. There are apps like dave which offers the opportunity to get a personal loan quickly. Also, the customer can get a quick cash advance of up to $1,000 using Loan Solo, one of the best Cash Advance Apps like Dave.

1. Earnin

The other best choice is to earn money. It's a money-related programme that's specifically developed to handle emergency situations. The tool is an excellent choice for full-time employees because it allows them to keep the money they have already earned. When it comes to features, it's very similar to Dave. If you require the money in an emergency, you can easily obtain it in advance.

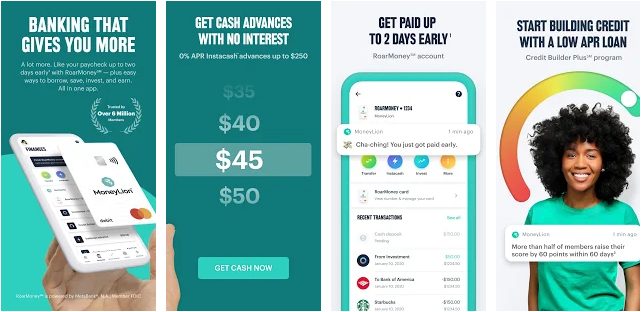

2. Moneylion

MoneyLion is also one of the most important advanced cash management apps. There are two types of memberships available: plus and core. The basic membership is inexpensive, but it comes with a slew of benefits, including free checking accounts, numerous awards, and a slew of other possibilities for users.

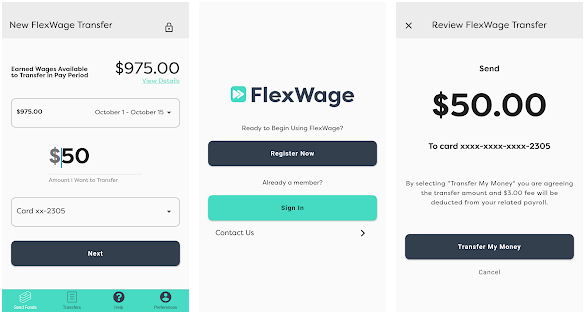

3. FlexWage

It, like other payday loan alternatives, assists employees in gaining access to their paychecks based on their needs. One of the reasons that these cash lending applications are becoming more popular is that they do not have to worry about the administrative headaches that come with the traditional payroll advances.

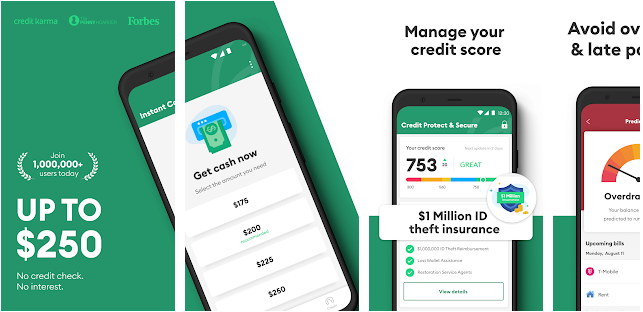

4. Brigit

It is one of the most popular services, with many users preferring it. If you're seeking for Dave-like apps, this is the greatest option and may be used for a variety of purposes. It is also a famous online tool that will assist people in having extra income and staying financially afloat till the next payout. This app will monitor the clients' accounts and keep track of the money they spend.

5. Rainy Day Lending

Rainy Day is not a lender and does not offer payday loans, but the cash loan app gives you the opportunity to get a personal loan quickly if you meet specific criteria. All credit cards are accepted here, and money can be placed into your account the next working day.

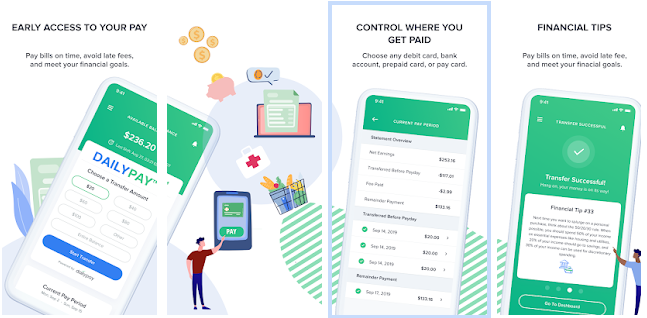

6. DailyPay

DailyPay is an app that begins by promoting to employees in various ways. The app, on the other hand, will function similarly to Dave and provide all of the features that users enjoy. Employees maintain a healthy work-life balance by providing excellent assistance and support to one another. They can also withdraw funds from the account before payday if they require immediate cash.

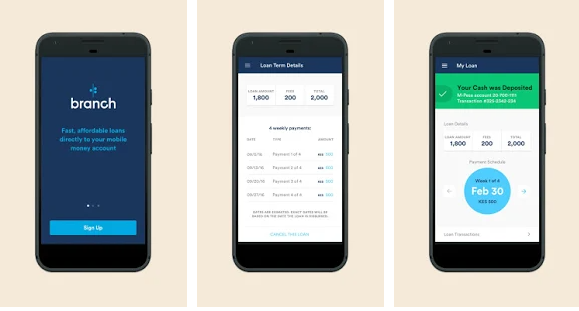

7. Branch

It's more like to one of the cash advance processes. It will allow the user to manage their work, such as change shifts, interacting with coworkers, and keeping track of the hours that employees work for the company. In addition, depending on the hours you must work, you can earn $5000 per pay period or $150 per day. In terms of versatility and speed, it's essentially identical to Dave.

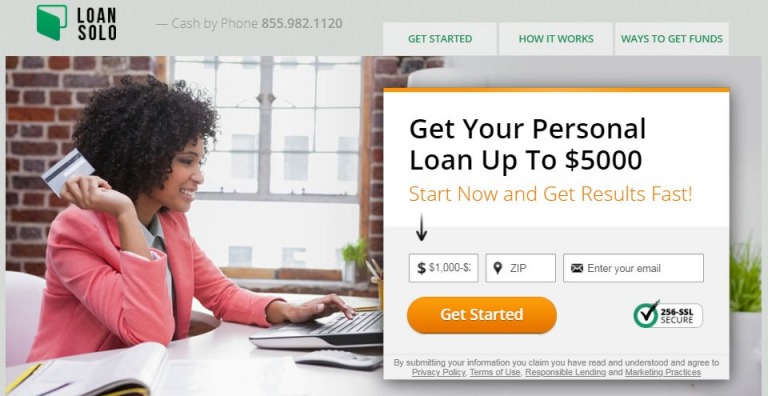

8. Loan Solo

It is also an app that allows users to connect with lenders that are eager to deal with them. It is possible to obtain cash immediately, and the funds will be deposited directly into the bank account without incurring any additional costs or inconveniences. The customer can get a quick cash advance of up to $1,000 and a personal loan of up to $3,000 here.

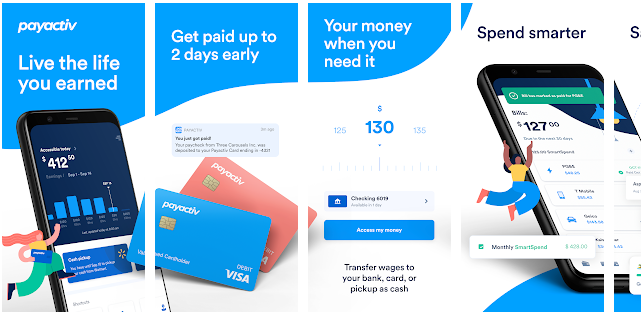

9. PayActiv

Like DailyPay, PlayActiv also allows users to access earned wages before payday. In addition to that, PlayActiv offers financial counseling as well. Apart from acting as a payday loan alternative, PlayActive also allows users to pay their bills and get prescription discounts using the app interface. It even has a debit card attached to the account so you can access your money quickly. To use PayActiv you can either set up a direct deposit to the card and use the app for free or you can opt to pay $1 per day as a service fee.

10. Chime

Like Dave, Chime is also one of the top online banking apps that provides several financial tools. It allows you to get early paychecks, grow savings, access a free overdraft facility and manage all your finances. This online banking platform also allows you to create a free Visa Debit Card, savings, and spending account. You can make real-time transactions, get balance alerts, send money to your loved ones and deposit checks. With Chime, you can also move money between various bank accounts instantly.

11. Wealthfront Cash Account

Wealthfront is a Robo-advisor that offers banking products, including a cash account. The best part about Wealthfront is that you can set up a direct deposit and get your money earlier. For example, you can get your money up to two days earlier than usual, depending on your payroll provider. Another feature that Wealthfront provides is the ability to automate quick investments from your cash account after you get paid.

12. Axos Bank – Direct Deposit Express

The Direct Deposit Express is a unique feature of Axos Bank that allows you to access your money up to two days earlier than your payday. Another benefit of Axos bank is that it does not charge any monthly maintenance fees or minimum balance requirement. There is also no overdraft on the account. You can manage all your accounts in one place using the personal finance manager at Axos Bank. Moreover, you can deposit checks, pay bills and manage funds from anywhere at any time.

13. PockBox

PockBox is yet another online lending app that connects you with short-term lenders that offer up to $2500 fast cash. You just need to fill a form and within few minutes you will be matched with a lender willing to transfer cash to your account by the next business day. Again, the APRs may vary according to your lender and the credit situation. But you will still be paying less through PockBox as compared to an online or offline payday lending service.

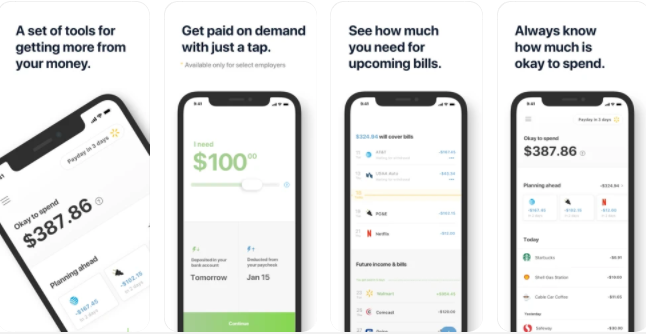

14. Even

Even is a leading financial planning app that offers cash advances of as much as 50% of the money you have earned. However, you can only avail the financial plans on this app if you are working for a qualified employer. The monthly Even Plus membership costs around $8 which is slightly more expensive as compared to Dave.

Unlike Dave, with Even, you can check your account three times a day. This quality app also allocates a specific amount from your bank account so that you don’t go through any financial problems towards the month-end.

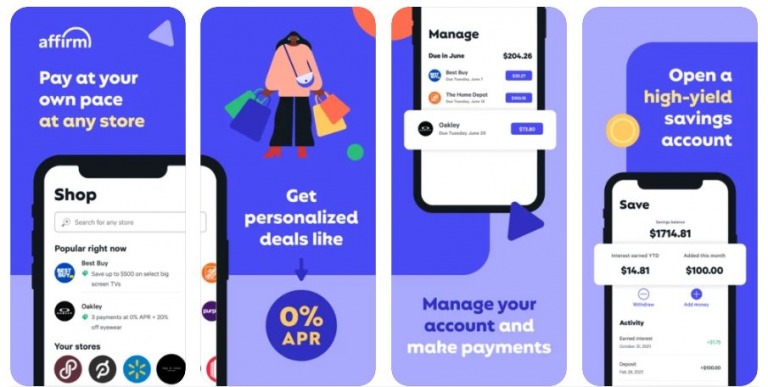

15. Affirm

Affirm is a finance application that allows you to divide your online purchases to make easy monthly payments. Affirm also works as a virtual credit card with no maintenance fee. All you need to do is fill out an application on the app and choose a suitable payment schedule that meets your spending habits. Once that is done, you can purchase anything from anywhere using Affirm. Moreover, you can also send money to your friends and family using Affirm.

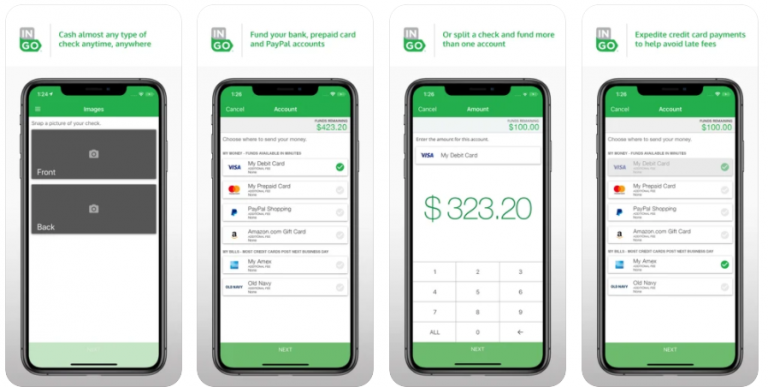

16. Ingo Money

Ingo Money provides a lot of similar features as apps like Dave, such as getting personal checks, cash paychecks, and business checks, anywhere and at any time. However, when it comes to money transfer, Ingo Money has better speed as compared to Dave. It transfers money within few minutes. Additionally, Ingo Money can also be used to pay credit card bills, transfer money to multiple accounts, and buy Amazon gift cards.

Another benefit of Ingo Money is that it allows you to register for a referral reward program. Here you can earn bonus points by referring a code to your friends and family and asking them to install the app using the code. This feature increases your chances of purchasing an Amazon gift card without spending any money.

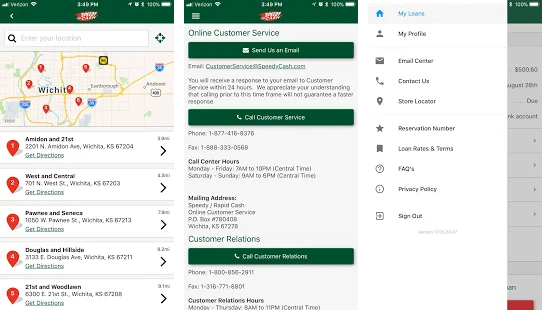

17. Speedy Cash

Like Dave, Speedy cash is a leading loan app that allows users to manage different types of loans from one place. It helps to manage your payday, title, and installment loans. Further, Speedy Cash offers a secure way to make payments, request a loan refinance, and select a bank account funding. You can also borrow a loan of as low as $50 to as high as $26000 with this application. All these features make Speedy Cash an ideal application for taking out a loan, managing lines of credit, and drawing extra cash on existing loans.

18. CashNetUSA

CashNetUSA provides quick and convenient credit whenever required. This application allows you to manage your lines of credit and get access to your account to make payments, view available credit, and request a draw. You can also use CashNetUSA to review your payment details, including past and future payments. CashNetUSA also offers coupons, discounts, and free financial courses to benefit the customers.

19. Activehours

Activehours stands out from any other cash advance apps because it pays you as soon as you finish your work. Activehours work for all business sizes, making it easier for workers to get paid instantly instead of waiting for their payday. But all this is possible if your employer also has an account on Activehours. Another benefit of Activehours is that it allows you to withdraw up to $100 from your paycheck every day with no additional fees for any withdrawal. This makes Activehours a more flexible app for daily wage-earners.

20. Instapay

Like Dave, Instapay offers many financial planning tools to its users. It helps to get some money on-demand between paychecks. It is an excellent service for saving money and mastering your bills. When in need of cash, you can use Instapay to send a cash advance request to your bank account within the business day. However, to use this feature, your employer must be registered with Instapay.

21. Empower

Empower offers Cash Advances of up to $250^ with no interest or late fees to pay.

When you sign up for an Empower Card, you can use it to get up to 10% cashback* on debit purchases at qualifying merchants or get free unlimited access to over 37,000 ATMs across the country. Plus, if you deposit your paycheck to the Empower Card you’ll also get your paycheck up to two days early.*

For people who need the flexibility to get quick cash advances, you can also get advances up to $250. There are no late fees, interest payments or credit checks for the advance. When you get your next paycheck, Empower will deduct the amount it advanced to you to balance your account.

Apps like Dave related searches

- $50 loan instant app

- apps like dave that work with chime

- apps like lenme

- apps like possible

- cash advance apps

- apps like dave reddit

- apps like moneylion

- dave app

Apps like Dave- FAQs

Is there a better app than Dave?

Earnin is one of the top money advance apps like Dave that give you access to up to $500 of financial assistance between your paycheck. The way Earnin works is simple. You can use the app to make a withdrawal of between $100 and $500 per day based on your working hours.

Are there any other apps like the Dave app?

Earnin works much like Dave, but there are no membership fees involved. You can also borrow more — up to $100 per day or $500 per pay period, depending on the hours you've already worked. ... It also has a Balance Shield program that helps prevent overdraft fees.

What app gives you instant cash?

Best for low fees. Earnin is a paycheck advance app that tracks your hours worked — using either a timesheet or by tracking your location — and lets you borrow money you expect to earn.

Is there any other app like Dave?

Earnin works much like Dave, but there are no membership fees involved. You can also borrow more — up to $100 per day or $500 per pay period, depending on the hours you've already worked. ... It also has a Balance Shield program that helps prevent overdraft fees.

Does Dave really give you $75?

Dave is a money management app with an emphasis on overdraft protection. By linking your checking account with the app, Dave tracks you expenses and texts you when you're coming close to letting your checking account fall into the red. The app lends you up to $75 as an interest-free loan if you need cash.

What is the catch with Dave app?

The Dave app provides users an advance on their paycheck to cover small expenses like gas or groceries. It also offers a “spending account” that charges no overdraft or low-balance fees. Instead of interest, Dave charges a monthly subscription fee that customers can opt out of.

How Much Will Dave let you borrow?

If it looks like you might overdraft, Dave gives you the option to borrow $25, $50 or $75 at no interest (if it sees a continual income of $500 or more). Dave is free for the first 30 days and $1 a month after that.

How fast can you get money from Dave?

The standard option is free, but it may take up to three business days to receive your money. The express option allows you to get your money the same day, but you must pay a “small” fee (Dave doesn't specify on its website how much that fee is).

How do I not pay Dave back?

To do this through the app, you have to:

- Open the app.

- Go to Account > Manage Membership > View Membership status.

- Select Manage membership.

- Scroll to the bottom of the page and choose Pause Membership.

- Select Cancel Membership to complete the process.